Corporate Governance

Basic Views

Fujikura Ltd. established the basic strategy of focusing on an early business recovery in light of the rapid deterioration in performance in FY2019 and narrowed the key measures to “the unreserved selection and concentration of existing businesses” and the “strengthening of Corporate governance”. We are resolutely implementing business structural reform, management reorganization, and organizational restructuring based on the 100-Day Plan, an operational turnaround plan formulated in September 2020. The top priority mission of management is to switch to the phase of creating corporate value through sustained growth after achieving early completion of the operational turnaround. Our basic views on corporate governance aimed at steady implementation of this strategy are detailed below.

Management Structure

Board of Directors

Fujikura adopted a “company with an Audit and Supervisory Committee” organizational structure in 2017 to separate the supervisory and executive functions. More than half of the internal directors resigned on March 31, 2021, creating a structure consisting of 10 directors in total, five of whom are outside directors (all Audit and Supervisory Committee members) and five of whom are internal directors. This raised the percentage of outside directors on the Board of Directors to 50%, strengthening the function of supervising the performance of duties by directors. The outside directors who make up half of the Board of Directors are independent of Company management and possess management experience and expertise in finance, legal matters, and other areas. These outside directors fully discuss important matters (formulation of medium and long-term strategy, business portfolio restructuring, etc.) concerning management with internal directors at Board of Directors meetings and make decision on them after sufficient debate.

Operational Execution Structure

In Fujikura, the Board of Directors may designate a Chief Executive Officer (CEO) and a Chief Operating Officer (COO) from among the executive directors, in principle. The CEO (hereafter, “Director, President and CEO”) serves as the Chair of the Board of Directors and as the CEO of the Group consisting of Fujikura and its subsidiaries (hereafter, collectively called “the Fujikura Group”; each subsidiary is called a “Group subsidiary”). As the person who exercises overall control over the performance of duties in Fujikura, the Director, President and CEO assumes ultimate responsibility for the pursuit of business by each business division and structural reforms, as well as supervision and oversight of corporate divisions. The COO is responsible for overseeing the pursuit of the core businesses of the Fujikura Group.

Audit and Supervisory Committee

The Audit and Supervisory Committee consists of six committee members in total. One committee member is a full-time internal director and five are outside directors who are independent of Company management. The Audit and Supervisory Committee Office was established and is staffed with exclusive, full-time personnel as the organization which supports the activities of the Audit and Supervisory Committee, at its direction.

Nomination and Remuneration of Directors

When making decisions on the following matters concerning the nomination of directors, the Nominating Advisory Committee, an advisory body to the Board of Directors (having an outside director as Chair and outside directors as the majority of committee members), verifies the fairness and appropriateness of the Board of Directors’ decision-making process.

・Draft proposals for resolutions of the General Meeting of Shareholders concerning election and dismissal of directors

・Criteria for election and dismissal of directors

・Successor plans

・Criteria for independence of outside directors

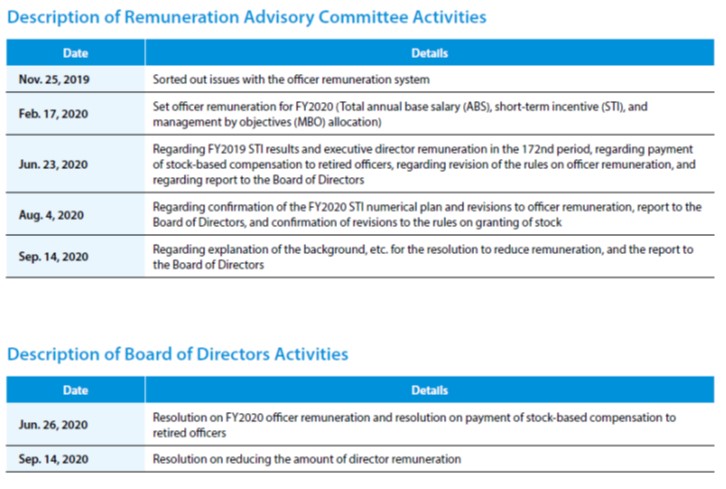

When making decisions on the following matters concerning remuneration of directors, the Remuneration Advisory Committee, an advisory body to the Board of Directors (having an outside director as Chair and outside directors as the majority of committee members), verifies the fairness and appropriateness of the Board of Directors’ decision-making process.

・Director remuneration and the system for determining the amount thereof

・The amount of remuneration for each director

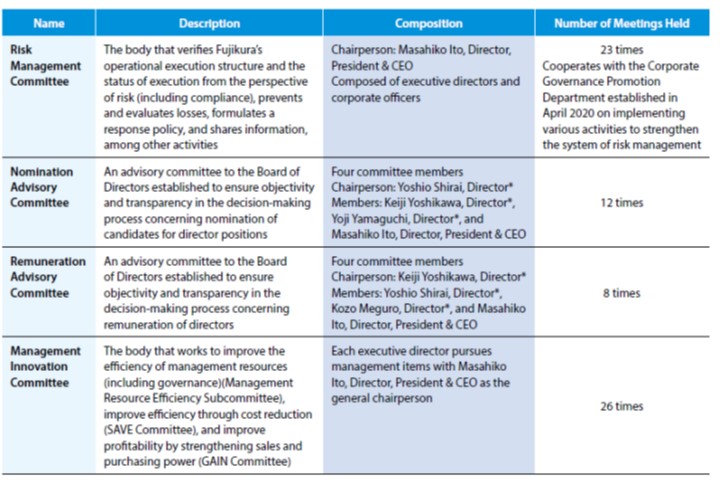

Committee Activities

|

|

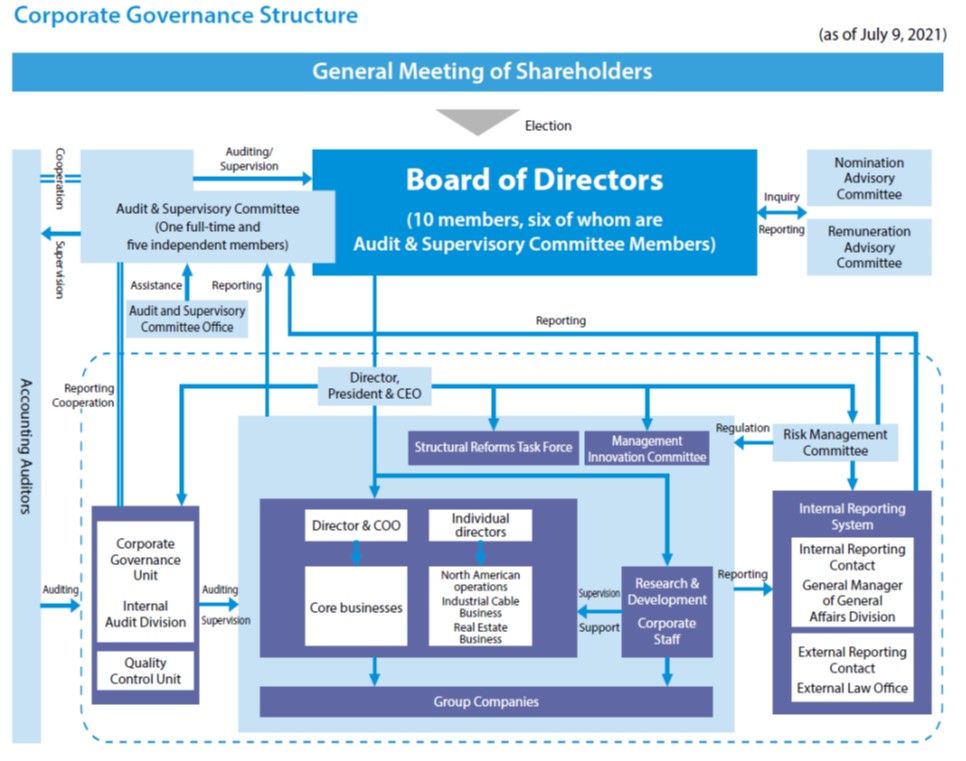

Corporate Governance Structure

|

|

Officers List

Please refer to this page for officers.

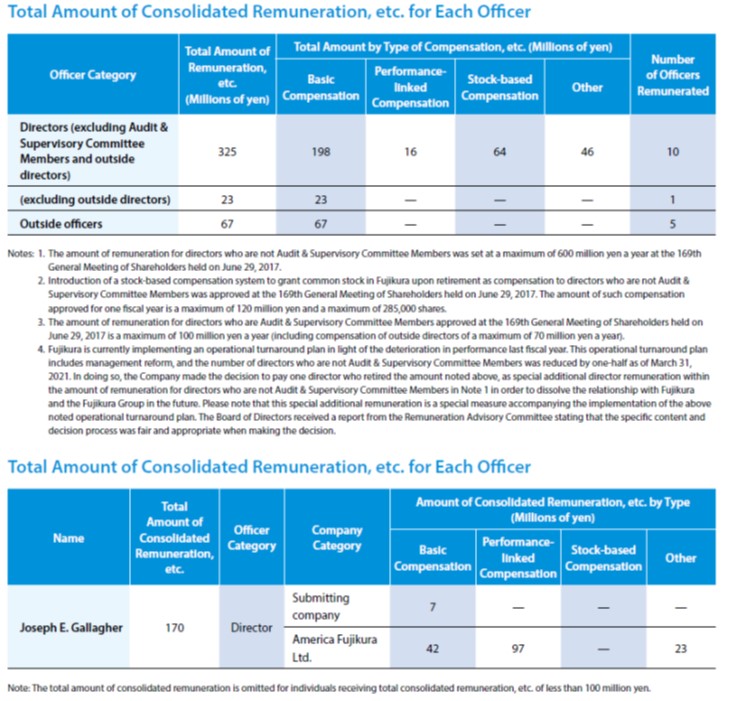

Remuneration

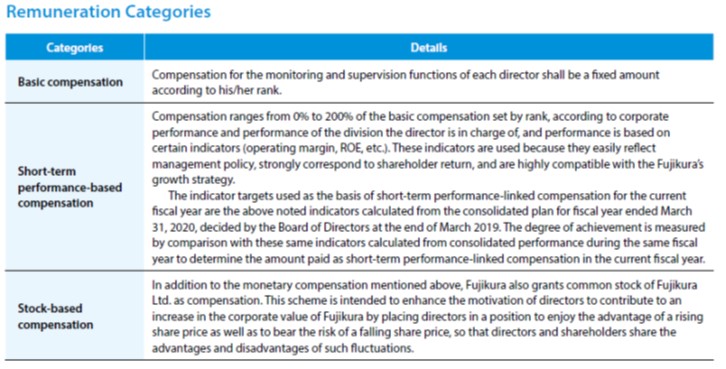

Policy and procedures followed by the Board of Directors to determine remuneration for executive management and directors

In addition to handling a large variety of products, Fujikura operates its business globally, and director duties are also highly complex and varied. Our basic policy is that the director remuneration should be at a level appropriate for outstanding human resources who are capable of accomplishing such duties. We have therefore classified director remuneration into the following three specific categories, based on the survey results from multiple research groups, mainly on listed companies. We have renewed our remuneration system based on objective indicators and evaluations while strengthening the linkage to performance.

Fujikura’s Board of Directors determines the amount of remuneration for directors who are not audit and supervisory committee members after it has been discussed by the Nominating Advisory Committee, which is an advisory body to the Board of Directors (and consists of the director in charge of human resources and three outside directors, and chaired by an outside director). The Remuneration Advisory Committee evaluates the performance of each director, examines whether the level of compensation is in line with the market, and confirms that the decision-making process concerning the remuneration structure and specific remuneration is appropriate. It then reports the results to the Board of Directors. The Board of Directors then takes these findings into consideration in determining the remuneration of directors who are not audit and supervisory committee members.

|

|

|

|

|

|

Analysis and evaluation of the effectiveness of the Board of Directors

A survey is conducted on the effectiveness of the Board of Directors and applies to all directors. The survey includes questions on the adequacy of Board meetings overall (time, frequency, management of meeting proceedings, minutes, etc.), adequacy of agenda items (timing, importance, volume of information, etc.), aspects of Board members (participation in discussions, etc.), and executive office function. Fujikura considers the results of the survey and takes remedial measures as necessary.

Based on the findings of this survey, Fujikura works to strengthen the structure to specifically ensure that 1) various materials are improved and explanations are provided to outside directors to give them a deeper understanding of the company and further enhance deliberations by the Board of Directors; 2) strengthen the structure to enable prediction, analysis, and investigation of risks, and rapid response when a risk materializes in operating divisions, to take the risk of incurring losses in business operations into consideration; and 3) review the agenda criteria for Board of Directors meetings to reduce the number of items related to normal business execution, allowing a greater focus on more important areas such as medium-to-long-term strategy.

However, some opinions submitted indicated the need for more discussion of medium and long-term strategy, issues, and the vision for the company.

Policy and procedures followed by the Board of Directors to appoint or remove executive management and nominate candidates for the position of director and auditor

At Fujikura, when the Board of Directors makes decisions on proposed resolutions for the General Meeting of Shareholders concerning the election and dismissal of directors who are not audit and supervisory committee members (excluding outside directors), it does so after the Nominating Advisory Committee, which is an advisory body to the Board of Directors (consisting of the president & CEO, the director in charge of human resources (the president & CEO is currently serving concurrently in this position), and three outside directors, and chaired by an outside director), has discussed them. The Nominating Advisory Committee deliberates on the selection criteria for directors and the reasons for selecting each director, including their performance, based on the candidates originally proposed by the Board of Directors. The committee confirms that the process is fair and appropriate, and presents the results of its deliberations to the Board of Directors. Based on the advice of the committee, the Board then submits a proposal for director candidates to be voted upon at the General Meeting of Shareholders.

Policy on cross-shareholding

Fujikura does not engage in cross-shareholding in principle. However, Fujikura may hold the shares of a company only if it is necessary for Fujikura to enter into a strategic business partnership in the course of its business activities and it will contribute to an increase in corporate value over the medium to long term. Fujikura sells off shares that it has decided to stop holding, and the Board of Directors receives reports on the sell-off of these shares. At the same time, the Board of Directors treats the shares as part of the invested capital of each business division and decides whether to continue holding them after examining their utility.

Measures to ensure that corporate pension funds perform their role as an asset owner

Fujikura has established a corporate pension fund (the Fujikura Corporate Pension Fund) to which it has entrusted the management of Fujikura’s pension assets. Fujikura Corporate Pension Fund subcontracts the entire management of the assets to asset management firms and monitors the management of those assets.

Fujikura takes care to provide the Fujikura Corporate Pension Fund with the necessary personnel and organizational structures to ensure that the fund can monitor the asset management firms (handling practical management) effectively.

Policy on constructive dialogue with shareholders

(i) Fujikura promotes initiatives by which the president and senior management can engage in dialogue with shareholders and investors as a means to achieve sustainable growth and increase corporate value over the medium to long term.

(ii) Fujikura places a director in charge of handling constructive dialogue to ensure the effectiveness of dialogue and information disclosure. This director oversees the IR Group in the Corporate Strategy & Planning Division, which cooperates with related departments to conduct timely, fair and appropriate disclosure of information.

(iii) Other ways in which Fujikura discloses information include its periodic conferences for analysts and institutional investors held four times a year (May, August, November, February), plant tours, and publications such as business reports and annual reports. The president and the director in charge of investor relations (the president & CEO is concurrently serving as the director in charge of investor relations from April 1, 2021) directly visit institutional investors in Europe, North America, and Asia to provide a rundown of business operations, give briefings on earnings performance, and present an explanation of the Mid-term Business Plan. In addition, extensive dialogue is carried out through pertinent visits with investors allowing opportunities to exchange opinions on matters such as the agenda of the General Meeting of Shareholders, the corporate governance structure, and ESG.

(iv) The president & CEO and the director in charge of investor relations (the president & CEO is serving concurrently in this position at present) provide adequate feedback on the results of interviews with the aforementioned shareholders and investors to directors.

(v) Fujikura has established a quiet period to prevent the leakage of financial information and ensuring fairness. During this quiet period, Fujikura does not comment on its financial information and does not respond to questions about this information. , Fujikura also works to prevent the leakage or spreading of important information, and prevent insider trading, under its rules on internal information management.

Messages from Outside Directors

|

Yoshio Shirai |

Contributing to Fujikura’s growth and development as a global company

|

|

Hamako Hanazaki |

Helping to create a better governance structure

|

|

Keiji Yoshikawa |

Using my own experience to support management while helping to build a system for cultivating management personnel

|

|

Yoji Yamaguchi |

Promoting discussion based on objective data and help to improve shareholder value

|

|

Kozo Meguro |

Supporting execution of a management plan that front-line workers can understand and take decisive action on

|