Company Data

Management Philosophy

Basic Concept

Fujikura has chosen to be a company with the Audit and Supervisory Committee. This is to establish a flexible and efficient business execution system by delegating a large amount of authority from Board of Directors' Meeting to executive directors. In addition, Fujikura's multiple outside directors, who are independent of management, have diverse and advanced knowledge and are able to conduct thorough deliberations, thereby strengthening the supervisory function.

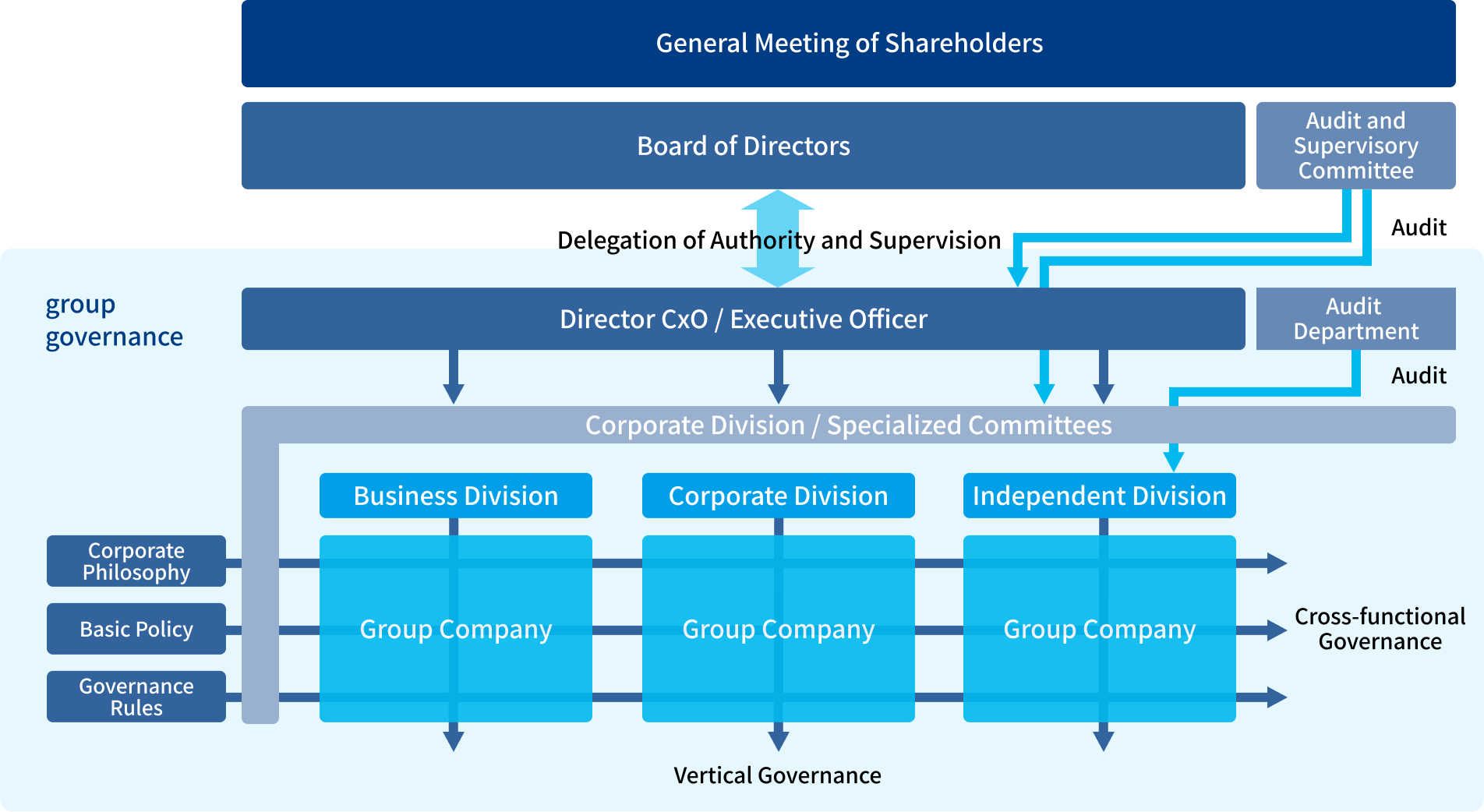

Fujikura Group 's corporate governance system, which reflects the above ideas, is as follows:

Governance system

(After the Ordinary shareholders' meeting for the fiscal year ending March 2025)

Board of Directors' Meeting

The total number of directors after the end of the regular shareholders' meeting for the fiscal year ending March 2025 is 10. Of these, six are outside directors, all of whom are independent of Fujikura's management (independent outside directors) and each have management experience and specialized knowledge in finance and accounting.

In addition, the Board of Directors' Meeting consists of six directors who are not Audit and Supervisory Committee members (including three outside directors) and four directors who are Audit and Supervisory Committee members (including three outside directors), and their management is led by full-time Audit and Supervisory Committee members, who are directors who are not responsible for business execution, from the perspective of strengthening the supervisory function of the Board of Directors' Meeting.

Board of Directors' Meeting decides on important matters related to management (such as the formulation of medium- to long-term strategy, review of the business portfolio, etc.) through thorough discussions between outside and internal directors with diverse knowledge and expertise.

Board of Directors' Meeting held 15 meetings during fiscal year 2024, and through thorough discussions including with independent outside directors, discussed, decided, and reported on matters such as the nomination of director candidates, matters related to compensation, the formulation of quarterly and annual management plans and confirmation of their progress, the formulation of medium-term management plans, the review of business portfolio, decisions on important investment projects, matters related to the restructuring of group companies, and other important matters related to management.

To ensure that Outside Directors are able to fully discuss matters at Board of Directors' Meeting, materials for Board of Directors' Meeting are distributed in advance, and meetings are held in advance to explain agenda items depending on their content (pre-Board of Directors' Meeting meetings).

Business Execution System

By resolution of Board of Directors' Meeting, we have established a system in which we appoint a Chief Executive Officer (CEO), Chief Technology Officer (CTO), and Chief Financial Officer (CFO). The CEO is the CEO for the entire Fujikura Group, the CTO is the chief executive officer in the field of technology development, and the CFO is the chief executive officer in the field of finance. With the CEO at the top, the CTO and CFO complement and support the CEO's functions in the fields of technology development and finance, which each require a high level of expertise. This "three-headed system" enables business operations based on more advanced and effective management decisions.

The Audit and Supervisory Committee

The total number of directors who are Audit Committee members as of the end of the regular shareholders' meeting fiscal year ending March 31, 2025 is four, consisting of one full-time internal director and three independent outside directors. the Audit and Supervisory Committee From the viewpoint of improving the effectiveness of the execution of duties of the Audit & Supervisory Board Members (hereinafter referred to as "Audit & Supervisory Board Members"), full-time Audit & Supervisory Board Members may attend and express their opinions at Executive Management Council other important meetings related to the execution of business In addition, the Audit Committee members are guaranteed the right to seek opportunities to exchange views and opinions with each business responsible person, with whom they meet on a regular and ad hoc basis. resolution In addition, an the Audit and Supervisory Committee office has been established under the direction of organization to assist the activities of the Audit and Supervisory Committee, and a full-time person has been assigned to this office. the Audit and Supervisory Committee met 17 times during fiscal 2024 to discuss matters based on the audit plan and other matters necessary for the supervision of the execution of operations by the executive directors.

Independent Outside Board of Directors' Meeting

Outside directors perform their duties as Audit and Supervisory Committee members or directors according to their specialized knowledge, from an objective standpoint independent of Fujikura's management. In order to ensure effective discussions at Board of Directors' Meeting, we will establish an Independent Outside Board of Directors' Meeting consisting only of independent outside directors after the Ordinary shareholders' meeting for the fiscal year ending March 31, 2025. This will enable outside directors to exchange information and share their views, and make recommendations as necessary.

Nomination and Remuneration of Directors

<Nomination Advisory committee >

When Board of Directors' Meeting decides on the following matters related to the nomination of directors, the Nomination Advisory committee which is an advisory body to the Board of Directors (comprised of a majority of outside directors and the chairperson of the committee by an outside director), is to verify the fairness and appropriateness of the decision-making process.

Main consultation matters

Proposal for the shareholders' meeting regarding the appointment and dismissal of directors

Criteria for selection and dismissal of directors

Succession planning

Independence Standards for Outside Directors

In fiscal 2024, the Nomination Advisory committee met a total of seven times.

<Remuneration Advisory committee >

When Board of Directors' Meeting decides on the following matters related to Director remuneration, the Compensation Advisory committee, which is an advisory body to the Board of Directors and is the chairperson of the committee by an Outside Director, is to verify the fairness and appropriateness of the decision-making process.

Main consultation matters

Disciplines for determining directors' remuneration and the amount thereof

Remuneration for individual directors

In fiscal year 2024, the Remuneration Advisory committee met a total of eight times.

Group Governance

In order to increase the value of the entire Fujikura Group and achieve sustainable growth, we aim to establish frameworks and processes that enable Fujikura Group to come together and operate as if it were a single company, and to establish a system that allows the promotion and management of these processes to be effective and efficient.

Schematic Diagram of th group governance system

Skills matrix for directors and Corporate Officer

- I = Information Infrastructure

- With optical wiring solutions based on innovative optical technology and future high-speed wireless communication technologies, we will contribute to building the information and communications infrastructure needed to realize a digital society.

- S = Information Storage

- Our unique electronic component technology and ultra-high density optical wiring technology contribute to the construction of high-capacity components and data center for storing massive amounts of data.

- T = Information Terminal

- With our high-precision electronic components and wiring/mounting technologies, we will contribute to the evolution of high-speed, large-capacity, and highly functional information terminals. We also consider automobiles to be information terminals, and will contribute to the realization and evolution of CASE.

- C = Carbon neutral

- Since carbon neutrality as an initiative to realize a sustainable society is also an opportunity to create businesses, we will promote the business of Fujikura's superconductivity technology and other technologies.

Policy for Determining Director Remuneration

The policy determining the remuneration of Directors who are not Audit & Supervisory Committee members and determining remuneration, etc., are made up of the Remuneration Advisory committee (consisting of the Director in charge of Human Resources and three outside directors), which is an advisory body to Board of Directors' Meeting, and the the chairperson of the committee are Outside Directors. After the report, it is decided to resolution with Board of Directors' Meeting.

The contents of the Decision policy on the details of individual remuneration for directors are as follows.

Fujikura Group not only handles a wide variety of products, but also has a global business presence, and the board's work is highly diverse. For this reason, the level of remuneration for directors is based on the fact that the level of remuneration for directors is appropriate for an excellent human resource that can respond to these tasks, and based on the results of surveys conducted by multiple research agencies, mainly targeting listed companies, the remuneration of directors is structured into the following three categories. Based on objective indicators and evaluations, the remuneration system has been re-established to strengthen linkage to business performance.

In addition, it is expected that the maximum amount of compensation (short-term performance-linked compensation and stock-based compensation) that fluctuates depending on business performance and stock prices will be about 60% of the total compensation.

On the other hand, the remuneration of directors other than executive directors is limited to basic remuneration, which is a fixed amount in view of their roles, and short-term performance-linked remuneration and stock-based remuneration are not paid.

Determination of remuneration for Directors who are Audit & Supervisory Committee Members policy and determination of remuneration, etc. are fixed based on the market environment and in light of their duties, and the amount of individual remuneration, etc. for Directors who are Audit & Supervisory Committee Members is determined within the limit of remuneration approval in shareholders' meeting and through consultation among Directors who are Audit & Supervisory Committee Members. The policy is determined by consultation with the directors who are Audit and Supervisory Committee members.

- Basic Remuneration

This portion corresponds to the monitoring and supervision function of directors and is set at a fixed amount according to position and grade.

- Short-term performance-linked Compensation

A basic amount will be set for each position and grade according to the company's overall performance or the performance unit in charge, and payment will be made within the range of 0% to 200% of the basic amount based on certain indicators (operating profit margin, return on equity (ROE), return on invested capital (ROIC)).

These indicators have been adopted because they are "indicators that easily reflect management policies," "indicators that have a strong correlation with the degree of profit return to shareholders," and "indicators that are highly compatible with Fujikura Group 's growth strategy."

The following two indicators are used as base values for the indicators related to "short-term performance-linked remuneration" for the business year under review.

① Consolidated fiscal year plan for the fiscal year ending March 2024, resolution by Board of Directors' Meeting at the end of the fiscal year ending March 2023

② Consolidated results for the fiscal year ending March 2023

The amount of short-term performance-linked remuneration to be paid for the current business year is determined by comparing the indicators calculated from these base values with the same indicators calculated from the consolidated fiscal year results for the fiscal year ending March 31, 2024, from the following two perspectives:

・Achievement rate against the consolidated fiscal year plan for the fiscal year ending March 2024 (corresponding base value: ① above)

・Degree of growth from the consolidated fiscal year results for the fiscal year ending March 2023 (corresponding base value: ② above) - Stock-Based Compensation

In addition to 1 and 2 above, Fujikura common stock will be issued as compensation to directors. The main purpose of this scheme is to increase directors' awareness of contributing to the improvement of corporate value by having them not only enjoy the benefits of rising stock prices but also bear the risk of falling stock prices, thereby sharing the benefits and risks of stock price fluctuations with shareholders.

In principle, the shares will be delivered when the directors who are not Audit and Supervisory Committee members retire.

Evaluation of the Effectiveness of Board of Directors' Meeting

- Improvements from fiscal 2023

Up until fiscal year 2023, Fujikura evaluated the effectiveness of Board of Directors' Meeting through a questionnaire survey of all directors. However, in fiscal year 2023, with the aim of further improving effectiveness, the company commissioned Board Advisors Co., Ltd., which has extensive knowledge and a proven track record in evaluating the effectiveness Board of Directors' Meeting, to conduct an effectiveness evaluation through a questionnaire survey of all directors, interviews with all directors and Board of Directors' Meeting Secretariat, review of minutes of Board Board of Directors' Meeting meetings, and attendance at Board of Directors' Meeting meetings.

In light of the issues identified in the effectiveness evaluation, Board of Directors' Meeting.

1) Sharing awareness of the role of Board of Directors' Meeting

The roles that Board of Directors' Meeting should play and the scope of responsibilities of the Audit and Supervisory Committee which is responsible for oversight functions, were discussed, and an attempt was made to share this understanding among the directors.

② Organizing the agenda Board of Directors' Meeting

We have further reviewed the criteria for matters to be discussed at Board of Directors' Meeting, and increased the importance of monitoring within the role of Board of Directors' Meeting.

3) Improving the composition of Board of Directors' Meeting We have clarified the role of Board of Directors' Meeting appropriate for the sustainable growth phase, as well as the roles and expectations expected of each director, and have reviewed its composition.

4) Review of Board of Directors' Meeting operations In particular, we have expanded opportunities for advance explanations to Outside Directors, in order to improve the efficiency and effectiveness of deliberations at Board of Directors' Meeting meetings.

- Implementation of the Fiscal 2024 Board of Directors' Meeting Effectiveness Evaluation and Results

In fiscal 2024, Fujikura conducted a questionnaire survey based on the results of the previous fiscal year, and commissioned Board Advisors Co., Ltd. to analyze and evaluate the results. The results are as follows:

① There was room for further expansion in discussions of important agenda items, such as medium- to long-term strategy and non-financial themes.

②There were multiple calls for consideration of the ideal composition of Board of Directors' Meeting, the skills matrix, and the ratio of internal and external members.

3) Regarding the "contribution of outside directors," it was apparent that there is a need to clarify the roles expected of outside directors by the business execution side in order to make the most of their qualities.

(4) There was room for improvement in committee 's coordination with Board of Directors' Meeting and agenda setting. - Future Initiatives

The issues and future initiatives based on the results of the analysis and evaluation are as follows:

① Expanding discussions on important agenda items Expanding discussions on medium- to long-term issues and non-financial matters.

② Review of the composition Board of Directors' Meeting Deepening discussions regarding the skills matrix of directors.

③ Demonstrating the qualities of outside directors Clarifying the roles of outside directors and ensuring their effectiveness.

Policy on Cross-Shareholdings

Fujikura says that it does not hold investment shares in principle policy. However, Fujikura will hold shares of the company as cross-shares only if it is necessary to enter into a cooperative relationship on a business strategy basis in the business conducted by Fujikura, and if such cooperation contributes to the enhancement of Fujikura's corporate value over the medium to long term. These cross-shareholdings will be positioned as part of the invested capital of each business units that conducts business, and will be verified as appropriate in accordance with the above policy holdings, and the Board of Directors' Meeting will decide whether to hold them. For shares that we decided not to hold, we report the progress of the sale to Board of Directors' Meeting. Based on the above policy, Fujikura has been actively selling its shares.

Changes in cross-shareholdings